At a time when environmental responsibility and sustainable practices are of paramount importance, the European Union has introduced a groundbreaking regulation to combat CO2 emissions associated with imported goods: the Carbon Border Adjustment Mechanism (CBAM). This mechanism aims to prevent carbon leakage – the relocation of CO2 intensive production to countries with less stringent climate regulations – and ensure that the price of imports reflects their CO2 content. For companies engaged in international trade, understanding and complying with the CBAM is not only a regulatory obligation, but a strategic necessity.

The CBAM is a central component of the EU's comprehensive climate protection agenda and aims to equalise CO₂ costs in the manufacture of European goods and goods imported from outside the EU. This mechanism directly supports the EU's ambitious climate targets by promoting cleaner industrial production worldwide and creating a level playing field by applying the same CO₂ costs to imported and EU-manufactured products.

At ARRK Sustainability Consulting, we offer - together with our cooperation partner FutureCamp Climate GmbH - a comprehensive service package that helps your company navigate the complexities of CBAM, from initial understanding to full compliance and strategic optimisation. Our services are tailored to the diverse needs of companies affected by this regulation and can be provided in German, English and Chinese as required.

We provide you with important knowledge and information products to ensure that your team is fully familiar with the requirements and implications of the CBAM:

Workshop "CBAM Basics"

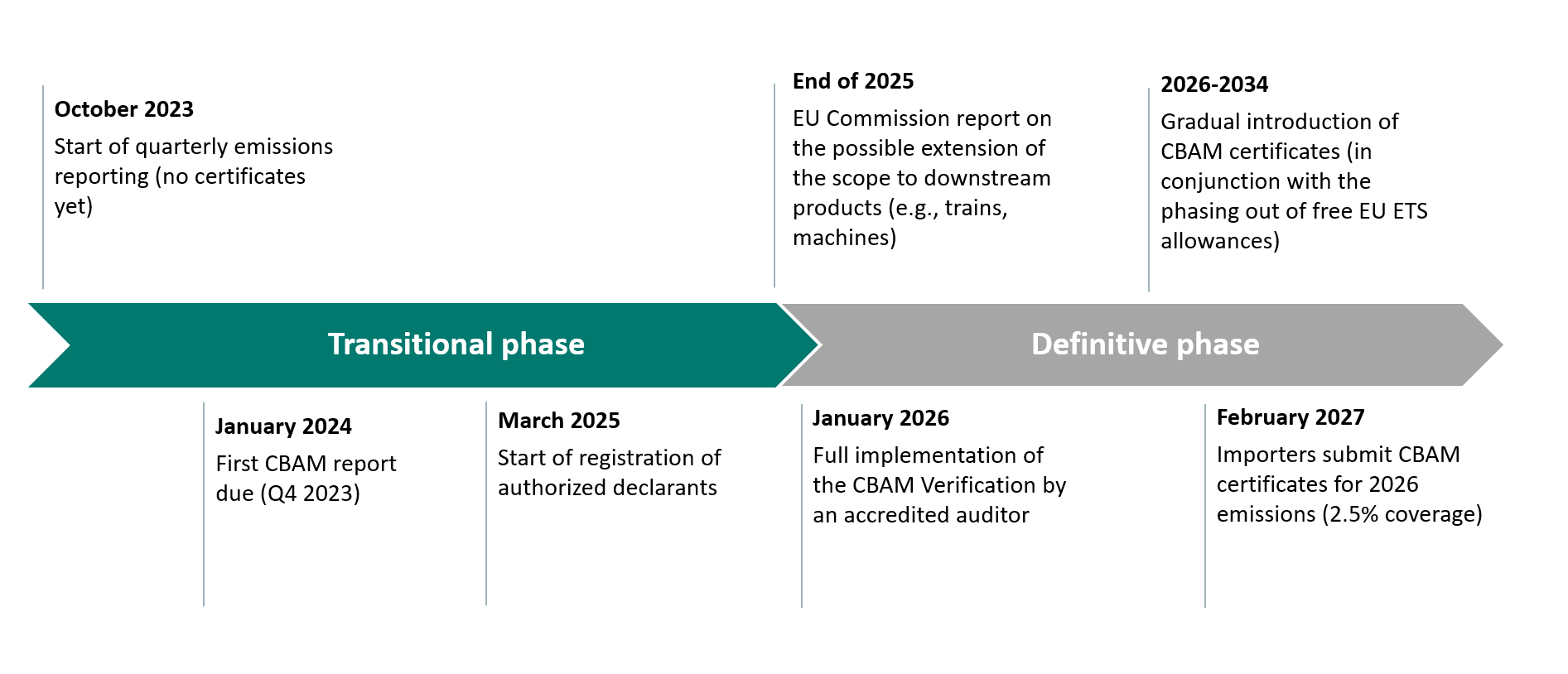

A basic workshop on the policy objectives, implementation timetable, general calculation and documentation of CBAM-relevant emissions (based on the rules for monitoring and reporting and for the free allocation of emission allowances in the EU ETS), the products and sectors affected, the key players and the general reporting requirements. (Duration: ½ day, online)

Workshop "Sector-specific CBAM reporting and monitoring requirements"

Tailor-made workshops focusing on the specifics of monitoring and reporting in various CBAM sectors, including insights into the concrete specific monitoring and reporting requirements under the EU ETS. (Workshop per sector, duration: ½ day, online)

Workshop on "Data requests from suppliers"

This workshop provides general information on collecting CBAM-relevant data outside your own area of responsibility, including an introduction to the EU Excel template for data collection, tips and recommendations for collecting data from suppliers, and examples of data queries and the establishment of internal processes in companies (keyword: establishing suitable governance structures for the CBAM). (Duration: ½ day, online)

Briefing paper "CBAM-related topics and background information"

Tailor-made briefing papers that address your specific questions and needs (industry- or country-specific) on topics such as the status of CBAM implementation, affected goods, financial implications, definition of CO₂ costs and monitoring methods. (Maximum 2-3 pages)

In addition to our knowledge products, we also offer individual consulting services to support practical CBAM implementation and ongoing compliance:

Project management

Comprehensive coordination during project implementation, facilitating communication between exporters and importers/CBAM registrants, with optional support in Chinese.

CBAM monitoring and reporting

Comprehensive support in identifying affected CBAM goods, preparing initial emission estimates using standard factors, and using the CBAM reporting tool (based on the EU Excel template). We assist our clients with data entry into the EU registry, optimise internal processes for CBAM implementation, and define monitoring plans in accordance with the requirements of the EU CBAM Directive. In addition, ARRK Sustainability Consulting supports the implementation of CBAM reporting in the EU registry.

Data requests from suppliers

We focus on optimising the process of collecting the necessary information. We support you in creating customised data collection tools for intermediate products and CBAM products, ensure quality control of the information and data provided by suppliers, and offer a dedicated helpdesk for effective communication with suppliers.

CBAM compliance

We offer you essential support in the purchase and trading of CBAM certificates, as well as in various registration activities, including registration, to ensure seamless compliance with CBAM regulations.